ZuluTrade alternative and comparison with competitor MyDigiTrade

This article provides comparison of ZuluTrade platform and ZuluTrade alternative competitor MyDigiTrade. This article outlines the similarities and differences between both social trading networks to help you choose the one that is right for you based on the following criteria:

- User Interface

- Markets and available assets

- Brokers and Trading platforms

- Copy trading

- Additional features

- Pricing

Choosing a right social trading network is a very important decision because you might choose to make part of the trades directly through it. Therefore when comparing ZuluTrade and alternative networks (ZuluTrade competitors) it is important to look at full range aspects and features they offer.

User Interface

ZuluTrade is one of the oldest social trading networks – it has been around for 10 years now. However, when we talk about user interface, age becomes a draw back rather than an advantage. Compared to competitor ZuluTrade looks slightly outdated and not nearly as intuitive. MyDigiTrade offers a brief video tour to get you acquainted with all it’s features and services, while ZuluTrade has a standard help section with user-guides in a footer. Another nice feature is the opportunity to choose between dark and light color schemes in MyDigiTrade. The older social trading platform has recently started experimenting with new layout, but at the time of writing it was only slightly different from the classic version. Both new and classic interfaces were still available.

|

|

Speaking of the overall look ZuluTrade is designed closer to a standard broker than a copy trading network. Main menu is centered around independent trading and you need to look to bottom left corner to find ‘Follow traders’ button. The service has some interesting features such as Social Charts or TradeWall, but they are also not immediately visible and are provided without no explanation on how to use. MyDigiTrade is ZuluTrade alternative that focuses primarily on copy trading. The first thing a user sees upon logging in to MyDigiTrade is a list of strategies available to copy with detailed statistics on each of them. Copying a strategy is designed to be a very intuitive process and can be done in a few clicks. Navigation between strategies, trading terminal and portfolio is also straight forward and simple. On top of those classic sections found in most social trading networks, ZuluTrade competitor offers statements — a convenient way to track your financial progress.

Markets and available assets

Both ZuluTrade and competitor provide limited opportunities for direct trading, but offer a wide range of assets through their partner brokers. ZuluTrade works with forex and binary options, while MyDigiTrade supports direct gold, silver and currency pairs trading. Upon registering an account with their partners a user can connect own account and use full range of assets provided by the chosen broker.

Brokers and Trading Platforms

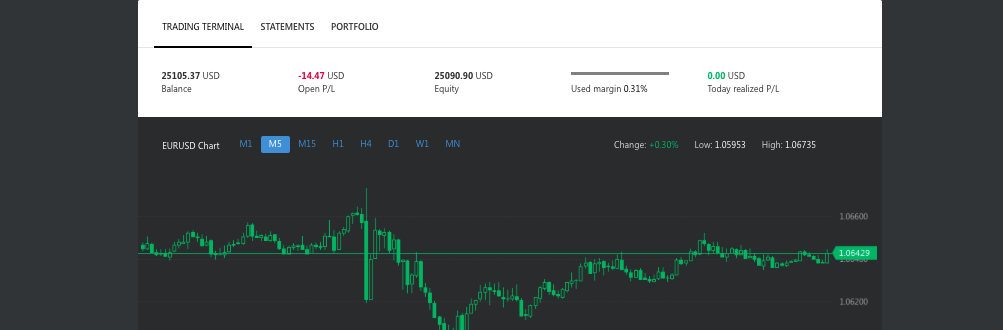

MyDigiTrade and ZuluTrade comparison revealed that both copy trading networks have a lot in common when it comes to brokers and trading terminals. While it is possible to open a demo or live account and trade via social trading platform directly, users are recommended to open an account with one of the partner brokers to get the most of social trading experience. By doing so you can connect MT4 at ZuluTrade or MT4 and several other terminals at MyDigiTrade and enjoy full range of terminal’s features and add-ons. On top of that ZuluTrade offers 2 trading terminals ZuluTrade + and ActTrader, and MyDigiTrade also provides own platform for trading.

Copy trading

Copy trading is the main reason to trade via social trading platform rather than a classic broker. ZuluTrade as the older platform has higher number of registered users than it’s alternative, but both competitors offer a good selection of strategies to choose from. A lot of ZuluTrade traders seem to sturggle with double-digit slippage when copying a trade which results in inaccurate strategy following. MyDigiTrade removes the risk element by letting a user set the maximum slippage or even set it to a negative number (in this case the trade will only be copied if an assets reaches a better price than a price strategy provider has opened his trade at). MyDigiTrade and ZuluTrade comparison also revealed significant differences in the way strategy providers are selected.

|

|

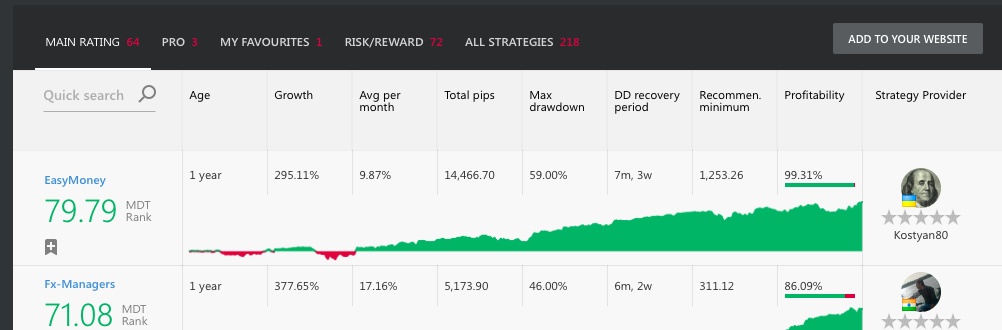

MyDigiTrade has strict requirements strategy providers must meet in order to be approved, at ZuluTrade there is no pre-screening and any trader can apply to participate in a program. MyDigiTrade is focused on listing only quality strategies and providing maximum opportunities for analysis and strategy comparison, strategies are ranked according to unique algorithm that assesses profit to risk ratio and strategy age along with several other factors. Top-ranked strategies are strategies executed for at least 9 – 12 months with maximum profit and balanced risks. ZuluTrade ranks all signal providers by a range of factors, such as maturity, exposure (max open trades), drawdown and performance (overall pips earned, average pips earned per trade, etc.).

Strategy analysis comparison

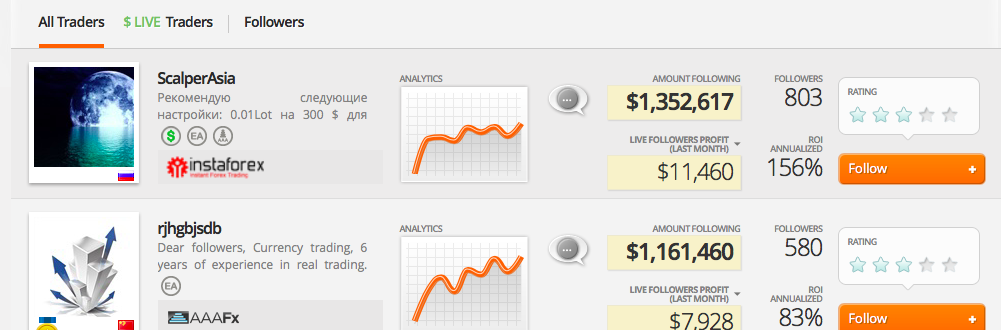

Let’s start with the features ZuluTrade offers for comparison:

- Analytics

- Amount following

- Live followers profit (last months)

- Followers

- ROI annualised

When you choose to have a detailed look at the strategy you also see trader’s rating, recent comments of other users about the signal provider, winning trades, average pips per trade, best and worst trades, etc. There are also charts which display drawdowns vs profits and traded assets and some features.

MyDigiTrade provides on the main strategy selection screen the following data:

- Strategy age

- Overall growth rate

- Average monthly growth

- Total pips

- Max drawdown

- Drawdown recovery period

- Recommended minimum

- Profitability

When you opt to take a detailed look you also see level of risk (high / low /average), growth chart, exact monthly profit/loss results for each of the previous 12 months, detailed trading statement for the most recent trades and a summary of all the important strategy information presented as a table (profit/loss, projected earnings, best/worst trade, etc.).

Most of MyDigiTrade statistical figures are based on equity (floating profits/losses are reflected in stats). On the contrary, in Zulutrade all stats are displayed based on balance figures, meaning that only closed trades are considered. This leaves strategy providers with an opportunity to hide actual drawdowns by keeping losing trades open for longer — to an extend where trader’s equity actually turns negative but balance is still looking extremely profitable on a ZuluTrade comparison chart. MyDigiTrade uses reporting system that is similar to hedge and reputable investment funds.

|

|

You probably noticed by now that ZuluTrade focuses on crowd trading. Number of followers and amount of assets under management first are supposed to be main factors to consider when choosing a strategy – this is often called social proof. It makes it harder for new signal providers to start and gain first followers and ranking and distracts traders from actually analysing a strategy. MyDigiTrade gives a lot of analytical information based on which you can make educated decisions. It’s a great service to copy traders whose investment style and risk margins meet your own style. Since ZuluTrade competitor combines information about every trade in a statement, this is also a great information source to learn Forex trading on mistakes of other people and improve personal trading skills.

Additional features

MyDigiTrade offers financial statements and in-depth charts and lets you determine wide range of parameters when following a trader — from allocating a fixed amount or percentage of your account balance to inverse trading and custom stop loss/take profit levels. ZuluTrade has TradeWall which is a live stream of all trades opened by signal providers, Social Charts, which are basically same thing as Trade Wall but grouped by asset and displayed in a form of chart, Traders Calendar and Pip Calculator. When choosing a strategy it lets you set a maximum amount to invest in it, maximum number of positions to copy and an opportunity to choose between fixed and pro-rata amount to invest in every trade.

Pricing

MyDigiTrade doesn’t charge users anything for copy trading service, as it receives commissions from brokers at no additional cost to the trader. They offer a very good selection of discount brokerages, some of which offer extra low spreads (around 1.5 pip on EUR/USD lot). Signal providers receive up to 50% of the spreads the company gets and the more profitable their strategies are, the higher is their pay rate.

ZuluTrade actively promotes AAAFx broker as a commission-free one, but when you take a closer look at their compensation structure you will know this is not true: instead of spreads AAAFx charges a fee $20 per lot, this is equivalent to 2 pips per lot. For all other supported brokers they charge additional 1-2 pips mark-up on a typical spread. Signal providers at ZuluTrade get paid 0.5 pips for each lot traded on their followers account.

MyDigiTrade offers a credit line of up to $150,000

The credit line allows you not to transfer all your capital to a brokerage account and invest only the sum you are willing to risk. We will add the remaining funds to your account as an interest-free credit. Click here to learn more.

During the past 10 years ZuluTrade has earned many fans but this network misses a lot of features a modern consumer is used too. ZuluTrade ‘s younger competitors have to work hard to attract new consumers and the best way to do so is by exceeding customers expectations. It seems that MyDigiTrade might outperform many oldschool social trading networks soon. ZuluTrade competitor might miss such perks as Calendar or Social Wall, but it has unique tools to help you trade, analyse and copy other trader’s strategies with confidence.

English

English

No comments