Ayondo alternative and comparison with competitor MyDigiTrade

Social trading is growing fast and if you are unhappy with your current platform whether it is eToro or Ayondo comparison shows you can easily find a perfect alternative. Don’t like the interface? Try to find Ayondo competitor with intuitive navigation. Think the rates are too high? Look for Ayondo alternative with better pricing. Before deciding which social platform to try next, read our Ayondo review and do your own comparison.

Getting around

Ayondo welcomes new traders with a complicated 3-page questionnaire. In order to open an account a user needs to provide a lot of personal details, including occupation and Employer name for working persons. Although answering multiple questions about your income, savings and investment goals may seem intimidating, you expect a personal investment advice upon completing this questionnaire. But don’t get over excited about it. The main objective of this assessment is to determine whether you have enough knowledge for trading riskier assets such as CFDs. If the analysis reveals that you are a novice, Ayondo displays a warning on trading risks and advises the user to learn about trading before placing live trades.

|

|

Opening either live or demo trading account with Ayondo alternative MyDigiTrade is very easy and only takes a few questions.

Interface

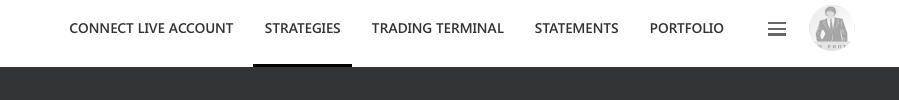

MyDigiTrade has done great work on making interface as simple to get used to as possible. The menu is clutter-free and well organised, so all important features required for copy trading are clearly visible. First page a user sees upon logging in is a list of strategies available to copy with plenty of details for analysis. By navigating through the top menu one can easily switch to trading terminal, checkout portfolio and statement tabs, personal stats and open trades.

|

|

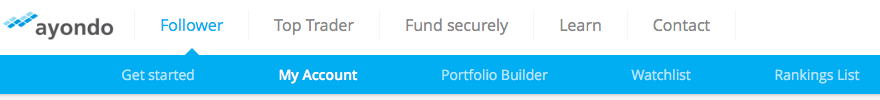

Ayondo is not a pure social trading platform, but a broker providing copy trading opportunities. This makes an impact on their user interface. Once you realise that signal providers are called Top Traders main menu starts looking fairly straightforward. It consists of 5 sections: Follower, Top Trader, Fund Securely, Learn, Contact. In our Ayondo review we will look in details into copy trading aspect of it. A follower can create several portfolios and copy up to five top traders within each of them. My Account menu is designated for tracking current balance, profit/loss and open positions. Portfolio builder tab lets a user add traders to follow via simple drag and drop, but doesn’t offer a convenient way to compare strategies, which is a big disadvantage and makes this tab literally not useful. To make an educated choice you need to first navigate to 4th tab — Ranking list. All recent actions of the traders one follows are listed under separate Watchlist tab. On a plus side, Ayondo comparison shows that the platform has a lot educational materials to offer.

Traders selection

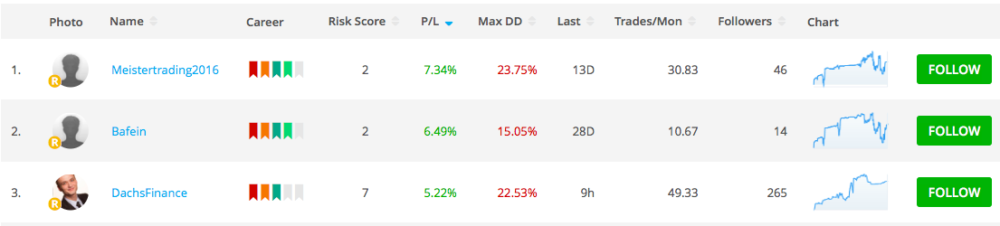

Ayondo used to have nearly 1900 traders available to copy, but only few of them actually had demonstrated stable financial results and growing followers base. Currently the platform offers only 75 top traders and a lot of them have under 50 followers. At Ayondo anyone can be a follower and a top trader at the same time. As a top trader you would start as a street trading and slowly increase your ranking to professional and eventually institutional investor – this ranking process is very similar to one in a computer game. Under Follower tab strategies are sorted by profitability by default. A user can then change this to risk score (calculated based on maximum drawdowns, volatility and average profits), max drawdown or number of followers.

|

|

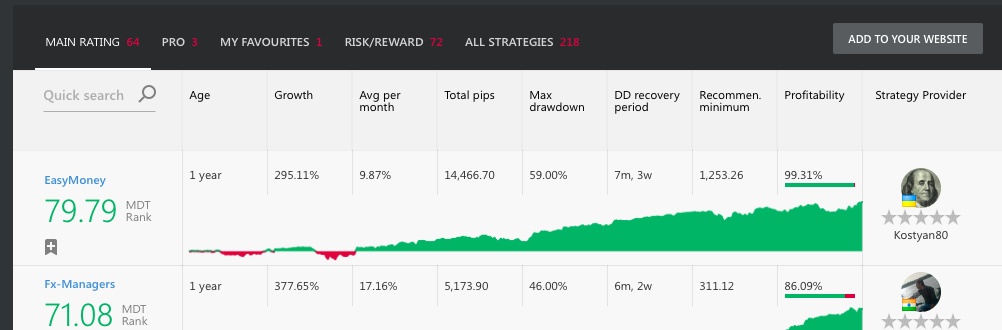

Ayondo competitor currently offers over 150 strategies. Strategy providers are pre-screened by a unique algorithm which analyses user’s trading history, including profitability, level of risk and duration of trading. Strategies with the highest score are displayed on the top positions (must be executed for at least 9-12 months). Additionally, a user can select to sort strategies by any of the 8 parameters in ascending or descending order (profitability, age, drawdowns, average profit per month, etc.).

Strategy comparison

Ayondo comparison of strategies is quite similar to MyDigiTrade, although Ayondo competitor offers slightly more data for analysis. In addition to profit, duration and maximum drawdown, MyDigiTrade provides important information about recommended minimum to follow a trader and average drawdown recovery period. Ayondo in it’s turn specifies when the last trade was executed, average number of trades per months and number of followers.

All strategies are equally distributed within trader’s Ayondo portfolio. A follower can manually adjust this setting by allocating different proportions of his portfolio to one strategy or another. However, Ayondo review revealed that there is no opportunity to set fixed amount to invest in a top trader within the same portfolio. Since MyDigiTrade provides a lot more options, Ayondo alternative wins whole 2 points in this simple comparison. At MyDigiTrade a follower can not only allocate fixed or proportional amount to a strategy, but also let the system find the best combination automatically based on risk and profit levels assessment. There are even more features such as setting own Stop Loss/Take Profit levels, Inverse trading (for running opposite trades to a selected strategy) and customisable lot sizes.

Trading terminals

Similar to many social trading networks on the market Ayondo has replaced classic MetaTrader Terminal with it’s own trading software. Ayondo terminal is called TradeHub and is available on both desktop and mobile computers. Although it is easy to learn and intuitive it misses the huge number of addons and trading robots that MT4 has to offer. Ayondo competitor also has it’s own simplified version of the terminal, but allows user to trade through MT4 and several other terminals offered by their partner brokers.

Minimum deposit and pricing

As it has already been mentioned in this Ayondo review, the company is a registered broker and is compensated by commissions it charges users directly. Minimum deposit is 1000 USD and Ayondo spreads on EUR/USD start from 3 pips. MyDigiTrade is a free service for the user with a 100 USD minimum deposit. Ayondo competitor gets commission from brokers the copy trading network partners with. The list of supported brokers contains 18 names, including XM.com, AvaTrade, Alpari, InstaForex, ThinkMarkets and many other famous brokerages. Therefore it is possible to select one with most suitable commission structure to accommodate your trading style. The best spreads on EUR/USD start from 1.5 pips.

MyDigiTrade offers a credit line of up to $150,000

The credit line allows you not to transfer all your capital to a brokerage account and invest only the sum you are willing to risk. We will add the remaining funds to your account as an interest-free credit. Click here to learn more.

This detailed Ayondo review and Ayondo comparison with competitor shows that although both social trading networks have their own pros and cons, MyDigiTrade has a lot more copy trading features to offer. This Ayondo competitor is taking copy trading to a whole new level by letting a follower stay in control of his portfolio and create settings that can eventually outperform the original strategy provider. If you are still not sure which social network to choose, MyDigitrade worth trying out at least with a demo account to start with.

English

English

No comments