Social Trading Networks Comparison: MyDigiTrade – eToro alternative competitor

What are the top eToro alternatives? Who is the main eToro competitor? If you’re wandering which social trading network to choose, today we are going to give you a detailed eToro comparison with it’s competitor MyDigiTrade. This comparison chart can be easily adopted to any other social trading platform, so keep reading to learn which features you should look for when choosing social trading network and finding reliable eToro alternative.

Volume of social trading is predicted to skyrocket in 2017 as more and more people are choosing to connect their forex accounts to social trading networks such as eToro and it’s competitor. The reason why it has become so popular is clear: social trading platforms simplify forex trading for beginners and people who don’t have time or skills for detailed market analysis.

Via eToro and alternative networks you can chat with other traders, see which open trades they have or set up automatic copying of your preferred trading strategy. Copy trading in a transparent social networking environment has many advantages over hiring money manager. For example, you don’t have to second guess anything, because trading strategy providers are obliged by the network to disclose real stats on their accounts.

|

|

How to choose the right fit among all social trading networks? Let’s have a detailed look at eToro and it’s competitor MyDigiTrade.

Interface

Both etoro.com and mydigitrade.com trading networks are well designed from the user perspective. Functionality is very clear and straightforward and you can always take a short virtual tour if you get confused. Although eToro does have a demo account, the social network doesn’t advertise it widely and you have to put in extra efforts to discover this option. eToro competitor MyDigiTrade wins a point for it’s simple registration process and a clearly displayed opportunity to open a practice account. eToro in its turn provides more opportunities for social interaction: you can create customised news feed to follow what other members say about specific topics or traders. It is also possible to watch a discussion on a currency pair, ETF or other asset. MyDigiTrade focuses on copy trading and provides built-in risk assessment and money management tools that may come in handy for managing your portfolio.

Traders and statistics on strategies

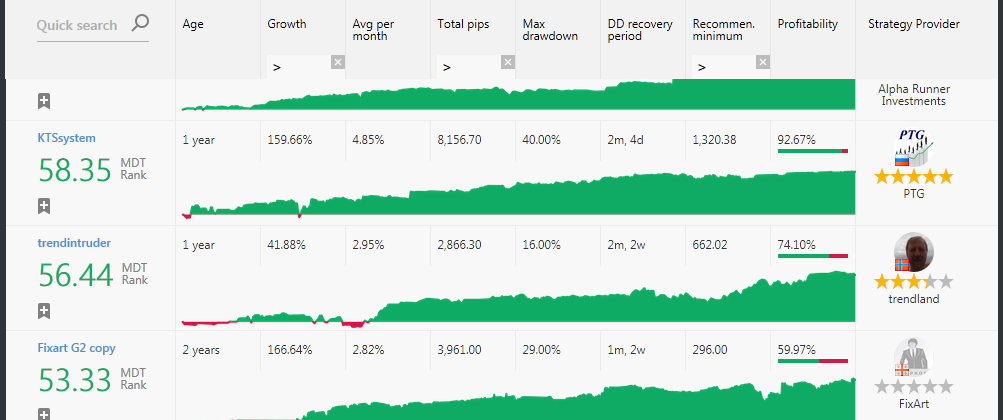

Although MyDigiTrade is a fairly new eToro alternative it offers a good selection of over 200 trading strategies to copy. All strategies must meet strict requirements before being approved. Such strategy filtering is a useful feature rarely offered by competitors in social trading segment. Statistics on strategies are displayed as infographics and are very easy to read and compare. When a strategy is selected you also get in depth statistics on average number of trades, margin, best and worst trades of a strategy provider, etc.

|

|

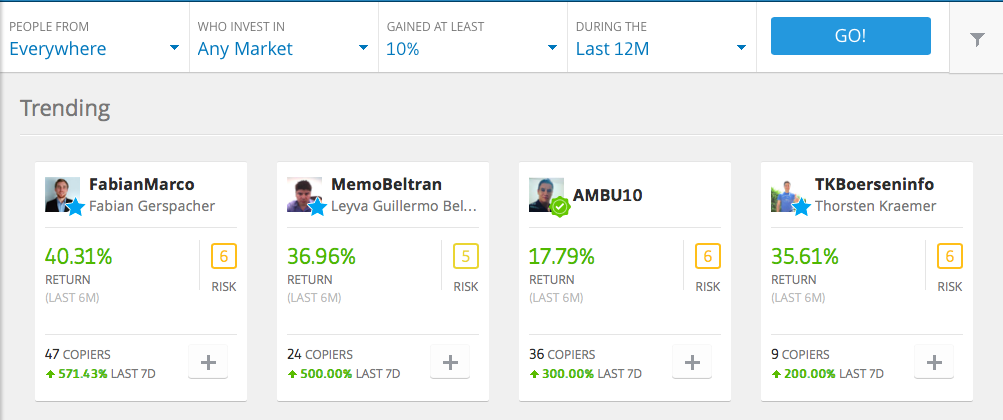

For comparison, eToro lets you search for traders and strategies using location filter, trading market, desired profitability within selected time frame. Return and risk score are displayed upfront, but you need to dig deeper and click on the trader name to get information about drawdowns. The platform has recently introduced a new service Invest in Copyfunds which offers to invest into a group of traders or market assets in one click.

Markets

eToro works with a wide variety of assets from forex currency pairs to commodities, indices, stocks and ETFs. Younger eToro competitor offers copy trading only on currency pairs, silver and gold yet. However, it is still possible to trade full range of assets through partner brokers MyDigiTrade has contracts with.

Trades

Both social trading networks provide opportunities to open trades directly on their website. Larger network limits your choice to it’s own trading terminal, while eToro alternative has it’s built-in terminal plus a selection offered by their partner brokers. Popular platforms such as Metatrader 4 become available when you open or register an existing account at one of MyDigiTrade partner brokers.

Charts

eToro offers fully functioning charts with opportunities to draw lines and display indicators and oscillators. MyDigiTrade has simplified yet functional version of a terminal where you can easily check your opened trades and assets/traders you follow, and rely on partner brokers fully functional terminals for in-depth analysis and your favorite forex robots.

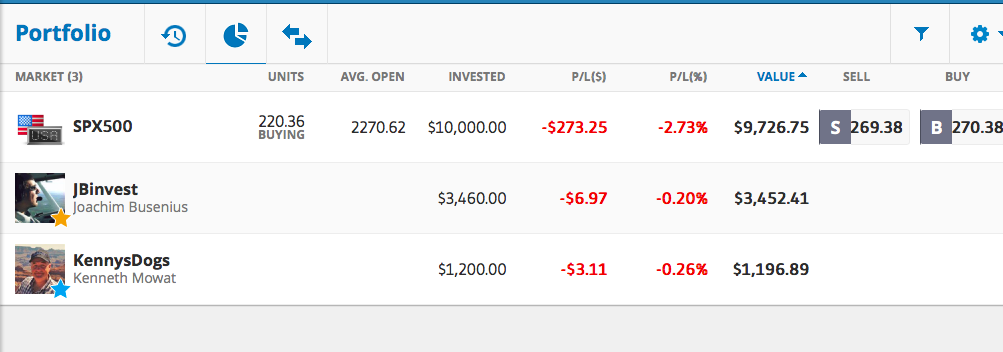

Copying opportunities

While in eToro you get to see what other copiers are saying about a trader in comments, you don’t have too many options for copying a trade or in-depth strategy comparison. All you can set is the amount of money you want to allocate to the strategy and a stop copying amount (both are exact numbers you have to define manually).

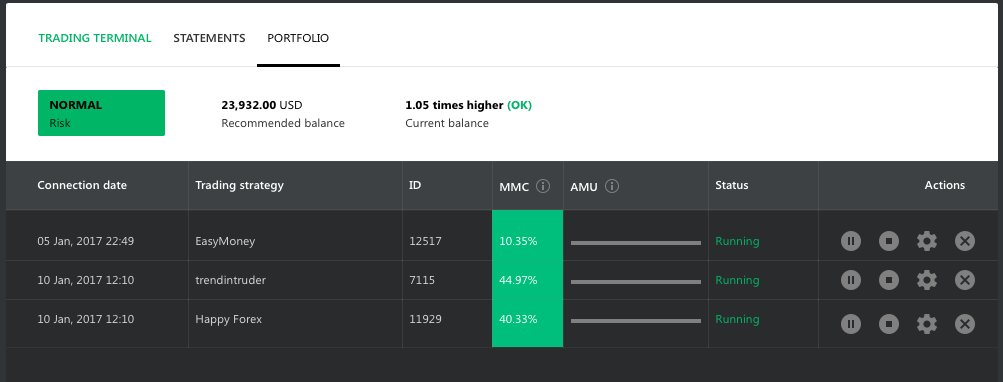

|

|

MyDigiTrade is a flexible copy trading platform with opportunities to allocate percentage of your account balance to the strategy, set a fixed amount of money to invest in a strategy or let the software automatically adjust your settings. Should you choose to have more control, there are advanced options such as limits on minimum and maximum lot sizes, pre-set stop loss and take profit, forced exit and stop and worst deviation levels. To take it to a next level you can limit quantity of simultaneous trades or opt for alternative inverse trading. The latter means you will be trading in an opposite direction of a selected strategy: if a seller buys EUR/USD, you automatically sell the currency pair, etc.

Minimum deposit

| MyDigiTrade | eToro |

|---|---|

| $100 | from $50 to $1000 depending on trader’s location |

Pricing

eToro is a registered broker and makes money on spreads and overnight fees on trades. The spreads are relatively high starting from 3 pips on EUR/USD. eToro competitor MyDigiTrade is a social trading network which gets paid by brokers it has agreements with at no extra costs to a trader. Some of those brokers offer spreads on EUR/USD starting from 1.5 pips, so if you’re concerned about high spreads at eToro alternative trading network MyDigiTrade deserves a detailed look. MyDigiTrade strategy providers also get paid from those commissions and their compensation amount depends on profitability: the more money they and their followers make, the higher their reward.

| MyDigiTrade Spread, EURUSD | eToro Spread, EURUSD |

|---|---|

| from 1.5 pip | 3 pips |

MyDigiTrade offers a credit line of up to $150,000

The credit line allows you not to transfer all your capital to a brokerage account and invest only the sum you are willing to risk. We will add the remaining funds to your account as an interest-free credit. Click here to learn more.

MyDigitrade and eToro Comparison – Conclusion

eToro offers brilliant socialising opportunities where you can follow others to create custom watch lists, newsfeed and share your thoughts about forex trading. It also provides opportunities to copy other traders and offers a wide selection of strategies. It’s alternative bets on convenience and detailed statistics, everything in this service is tailored to offer high quality copy trading with plenty of options to choose from.

If you are interested in social trading networks for practical reasons rather than chatting with fellow traders you may find MyDigiTrade more valuable. If you are joining social trading networks mainly for socialising, eToro may be more suitable than it’s competitor.

English

English

No comments