How to become a millionaire — Compound interest for dummies

If you think of the ways to become a millionaire, you are already in a much better position then most people, who never even dare to ask such question. Achieving this goal is easier then majority of your friends think, but it requires self-discipline and determination. For example, one can become a millionaire in 5, 10 or 20 years simply by saving money and accumulating compound interest. But in order to do so you need to adapt a millionaire mindset and learn the «pay yourself first» principle.

Compound interest meaning

Compound interest is profit one receives on reinvesting interest (or, n other words, interest on interest). Compound interest meaning is easier to understand on an example.

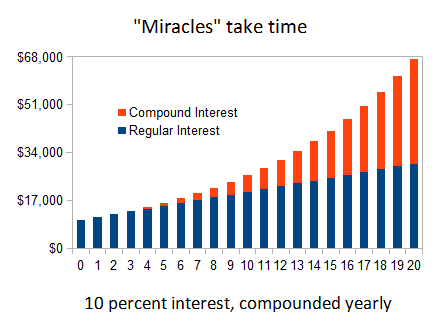

To keep things simple, let’s say James invests $10 000 with 10% annual return. During first year his profit is $1 000. He chooses to re-invests that $1 000 along with $10 000 he already owns. During second year his profit is $1 100, on top of the $11 000 he already owns. In 10 years his initial investment of $10 000 will turn into $25 937.42 without any additional deposits.

For simplicity in our example James gets interest paid yearly. If interest was compounded daily, instead of yearly, during first year he would make $1051.56, during his second year – additional $1 162.14 and in 10 years his capital would grow to $27 179.10

Compound interest vs simple interest

A simple interest is a plain interest paid on the initial deposit. This means that interest is not accumulated (for example because an investor chose to take and spend profit).

Example: Jame’s brother John also has $10 000 to invest with 10% annual return, but unlike James he choses not to use compound interest method. During first year his investment brings him $1 000 return, which he spends right away. Then, next year he receives another $1 000. After 10 years John will still have $10 000 plus another $10 000 of profit he took away. This way his investments with simple interest generates almost $6 000 less than Jame’s investment with compound interest.

What happens if we take inflation into account? Will compound interest investment still be more profitable? If we assume that inflation bounces around 2% (a target inflation rate set by US Federal Reserve System), then we clearly see that both compound interest and simple interest deposits outperform it. Over 10 years inflation will “eat up” $2 190 of initial investment of $10 000.

In a compound interest versus simple interest battle, compound interest method is a clear winner.

Becoming a millionaire with compound interest

At this point, you probably have enough information about compound interest meaning, but are still wondering how does this help James become a millionaire?

Imagine a 20 year old student Janet who has $1 000 to invest with 10% return. After initial investment she keeps adding $100 per month to the same account. To keep this example as close to real life as possible, we will compound interest quarterly. In 44 years Janet will be a millionaire. By the age 65 (time to retire) she will have $1 112 021.43 on her account.

Compound interest works best over the long run. If you have larger initial deposit or can afford to save more money every month, than you will reach this goal faster.

Now if you think that 10% interest rate is unrealistic, think again. Average annual return of S&P 500 from the time it was introduced till now is around 10%. In 1990’s decade the benchmark averaged 18,1%, in 2000’s fell by 1%, but grew on average by 15% annually during next 7 years. So far in history, despite all economic crises, in the long run stock market always growth. Since this article explains compound interest for dummies, let’s specify that S&P 500 is a US stock market index that includes 500 large companies listed on NASDAQ Stock Exchange and New York Stock Exchange. One can invest in the index by buying the same stocks as in the index (takes a lot of money) or by investing in a mutual fund that only holds stocks included in the index (easiest way to invest in S&P 500). Of course there are a lot of other ways to invest money with 10% or even 30% annual returns. The only reason why we are talking about S&P here is that it is very commonly used as an investment benchmark.

What else can you do to become a millionaire?

If you don’t want to wait 45 years to accumulate your first million dollars (and who does?), you need to find a way of increasing your income. Start with adapting a millionaire mindset – learn from people who already made a fortune and see how the way they think differs from the way poor people think. No truly rich man earned his capital by being a salaried employee. Salaries simply don’t grow fast enough for such an ambitious goals. Now, that doesn’t mean that you need to quit your job right away. There are a lot of ways to create passive income online while you are still employed. To become a millionaire faster consider the following paths:

- create passive income online through investing / trading

- make money online by starting a side business

- create a classic brick-and-mortar business (requires more time and money to start)

If you think that you don’t have enough time for doing any of the above or don’t have required knowledge, skills or right personality type, block those dangerous thoughts right away. This is exactly what stopes an average person from becoming a millionaire. Remember, that amateurs built the Ark, professionals built the Titanic. If becoming rich is something you are really determined to achieve, never let the fear of failure stop you from trying. Of course, your start-up may fail or an investment may return a loss, but that will also provide a valuable lesson. If you approach success ladder with persistence and keep learning from your failures, eventually you will get where you want to be. Persistence and determination to make things happen instead of waiting for them to happen is what separates millionaires from the rest of the crowd.

Many problems that seem unsolvable have a simple solution, you just need to discover it. For example, you wish to start investing, by don’t have time to learn how to do it yourself. Why not overcome this struggle by investing in stocks or currencies via copy trading?

No matter which way you choose to make money and how much money you make, you won’t become a millionaire without good saving habits. Get free of debts and teach yourself to spend less then you earn. Aim to save as much as you feel comfortable, but do this on a regular basis and rely on compound interest to accumulate your fortune. Make sure part of your capital is invested in low risk assets such as S&P 500 index mentioned above and keep growing your fortune until it reaches $1 000 000. If you have higher risk tolerance (are able to remain relatively calm if the asset price go down), you may experiment with potentially more profitable and riskier investments with the rest of your money, if that is inline with your financial goals, but try not to do this with all your capital.

English

English

Comments

1Excellent post. I definitely love this website. Keep writing!