How to invest in bitcoin and earn – Cryptocurrency for dummies

Some people call it the new gold, others refuse to treat it as a serious asset. However, more and more people are looking for ways to invest in bitcoin and make money. Fortunes have been made and fortunes have been lost on bitcoin fluctuations during past 8 years. This internet currency can bring 400% return in just half a year, but it also can fall by 50% or even more in just several days. Making money online with bitcoin is a tricky road, because this currency is extremely volatile and often hard to predict but this investment can also be very profitable.

What is bitcoin

Bitcoin is a digital currency that utilises the blockchain technology. This cryptocurrency is not controlled by a central bank or any centralised authority, but is regulated by the community of people called “miners”. De-centralisation is considered the main advantage of bitcoins. Each bitcoin is a unique digital code block. People can buy or sell bitcoins on bitcoin exchanges, transfer them to other users or store them on special websites.

How to predict bitcoin market price

Bitcoin is highly volatile and this is what makes it too risky to invest in bitcoin long term, however you still can invest in bitcoin to make money daily. First of all you need to understand how the price of bitcoin changes. There are different factors that can influence the cost. First of all, watch out for talks about when the last bitcoin will be produced. The subject can be used by speculators to temporarily increase or reduce current bitcoin market price. Second important factor is safety of bitcoins, although it is said that one can’t fake bitcoins, there are several cases of robberies reported online. The most famous one was the Mt Gox bankruptcy, after which price of bitcoins fell sharply. Changes in government regulations in larger countries can also affect bitcoins market price. Sometimes the internet currency also reacts to important economic events, it may rise ahead of important elections or a referendum, but such political or macroeconomic news have only limited influence on bitcoin. The main factor determining bitcoin market price is global demand.

Bitcoin supply and demand

It is important to know that blockchain technology limits the amount of bitcoins that can he produced, so the supply of bitcoins is limited. Demand for bitcoins depends on general moods in the global community. Currently the strongest demand comes from China. This has been boosting the price of digital currency. Outside China people from other developing countries also show increasing interest to bitcoin. For example, in early 2017 there was a strong demand growth from India. Unfortunately, central banks and governments in the majority of developing countries still haven’t decided how to treat virtual currency. Although bitcoins are hard to ban completely, lack of regulation also means lack of protection for bitcoin investors.

Where to buy bitcoin

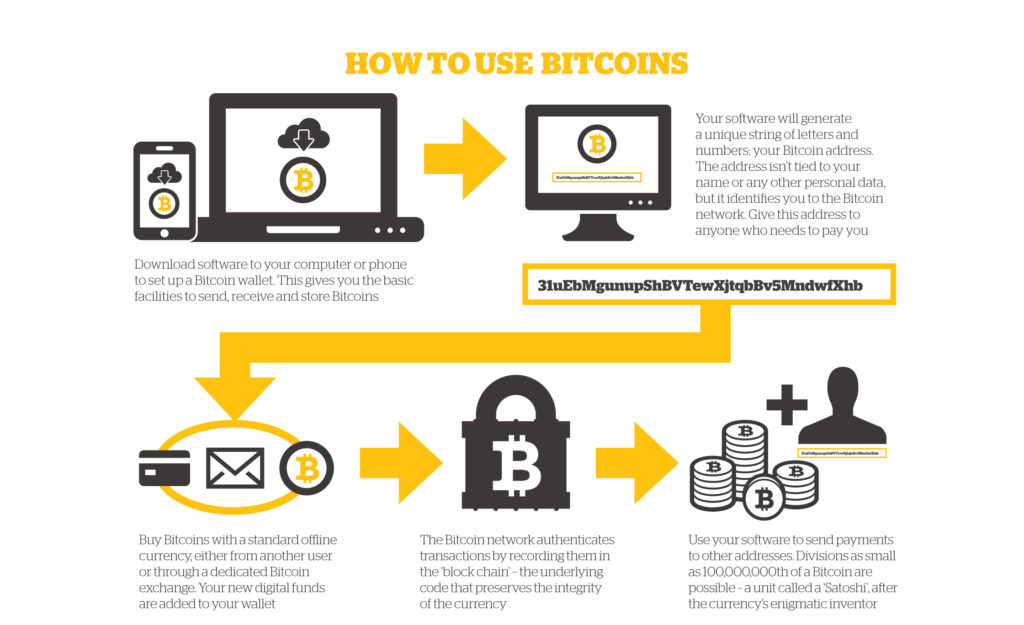

Investors can buy bitcoin online from a bitcoin exchange, directly from other bitcoin owners or on a bitcoin marketplace. There are ways to pay for bitcoin with cash, bank card or a wire transfer. A lot of bitcoin sellers don’t accept credit cards and Paypal payments, because these money transfers can be easily canceled by the user later (for the seller it’s hard to proof that bitcoin was actually sent to the buyer). Once you decide to buy digital currency you need to create a digital wallet (bitcoin wallet). Bitcoins can be stored offline on your computer via special software, online on exchange websites or vaults. Although bitcoin is not a stock it is now offered by many retail brokers marked with a code BTC. BTC/USD and BTS/EUR are the most commonly traded currency pairs.

How to invest in bitcoin

Ones you figured out how to buy bitcoin and created an online wallet, you can try to invest in bitcoin and make money on its price changes. Despite being a digital currency, bitcoin as an investment is more often compared to gold then to other currencies. Supply of both assets is limited plus a lot of people choose them as a way to store money. Not everyone will agree with calling bitcoin a new gold though. Unlike the precious metal this digital currency is too unstable. Conservative market analysts say that bitcoin needs to be around for many more years before it can be viewed as a safe haven asset. Be careful if you are considering long-term investments in bitcoin, and try to invest in bitcoin to earn daily at first. Over last 5 years bitcoin brought 155% return, where gold experienced a 6% loss, but it is hard to predict further dynamic of the digital currency. There are clear signs of a bitcoin bubble that may burst anytime soon.

If you still want to invest in bitcoin you can do so through online bitcoin exchanges.

Bitcoin investment advice

There are some people highly devoted to digital currencies, who call themselves professional bitcoin advisors. Keep in mind, that bitcoin still lacks clear regulation in most countries and those people may or may not have proper training. However, some licensed money managers and consultants work with bitcoins along with other assets.

Anyone seeking bitcoin investment advice faces the same problem. Financial experts offer controversial opinions about this asset. Part of the advisors admire flexibility and high investment potential of bitcoin, while others criticise it for high volatility and unpredictability. Because the digital currency is still relatively new, it’s very hard to tell who is right. Before following bitcoin investment advice, have a clear picture of your own investment goals and plans. It is best to hear both sides before making a decision to invest in bitcoin or steer clear from it.

Remember, that bitcoins are classified as high-risk investment, so it is wise to add some conservative assets to your portfolio (gold, USD, etc) to balance your risky bitcoin buy/sell operations.

Bitcoin alternatives

Bitcoin is the first cryptocurrency and the most famous one, but it has many competitors. Let’s see how BTC trading volume compares to peers.

Bitcoin

Launch date: January 2009

Trading volume in 2017 (within 24 hours): around 400 million US dollars Market cap: 20 billion US dollars

Ethereum

Launch date: July 2015

Trading volume in 2017 (within 24 hours): around 400 million US dollars

Market cap: 3.5 billion US dollars

Ethereum, first introduced to the market less then 2 years ago, overtook bitcoin in trading volume for the first time in March 2017. Ether is famous for it’s smart contracts and few other features that bitcoin doesn’t offer. Smart contracts run on a blockchain protocol and offer safe way to make arrangement and transfer payments only when certain conditions are met. For example, they are often used by developers to raise funds. Under such contracts various investors can send money to support a start-up, but the funds will only be released when/if the fundraising goal is met. Otherwise, the money return to senders.

Dash

Launch date: March 2015

Trading volume in 2017 (within 24 hours): around 70 million US dollars

Market cap: 700 million US dollars

Dash is famous for providing anonymity to money senders and receivers through it’s Darkness algorithm. Unlike Bitcoin where all transactions of the coin are traceable, Dash allows users to stay unknown.

Litecoin

Launch date: October 2011

Trading volume in 2017 (within 24 hours): around 200 million US dollars

Market cap: 350 million US dollars

Litecoin has been around for considerably long time. If you are not sure whether to invest in bitcoin or litecoin. It’s good to know that key advantage of litecoin over bitcoin is faster transaction processing time. With more bitcoin transactions being recorded for each block of code, the bitcoin system gets slower. If bitcoin community doesn’t offer a solution to this problem, this advantage of Litecoin will become more and more significant.

There are over 700 cryptocurrencies available online. With bitcoin price skyrocketing by 2017, investors, who missed this opportunity, started paying attention to its alternatives in hopes that other cryptocurrencies will demonstrate similar performance.

Conclusion

While cryptocurrencies seem to be currencies of the future, investing in bitcoin and it’s alternatives is a hard skill to master. When asset is on the rise it gets a lot of attention but in this overall euphoria it is very easy to bypass warning signs and loose money. When an asset rises in price 1000% over short period of time, it will most likely turn around at some point. Today anyone can learn how to make money online, but this process takes time, patience and a certain number of mistakes. If you invest in bitcoin now, you need to consider risks and be prepared for a negative scenario. If learning to invest by trial and error doesn’t suit your situation, consider other ways to create passive income online, such as hiring money manager or investing through copy trading.

English

English

No comments